The International Group of P&I Clubs (IG) has finalised its Pooling and Group Excess of Loss (GXL) reinsurance structure for the 2026/27 policy year, introducing two key changes as the environment shifts back toward higher levels of pool claims activity.

“Following a relatively benign Pool claims environment for the 2022/23 and 2023/24 policy years, the 2024/25 and 2025/26 policy years have seen a move back towards a higher level of pool claims activity, more consistent with the 2019-2021 period,” IG explained.

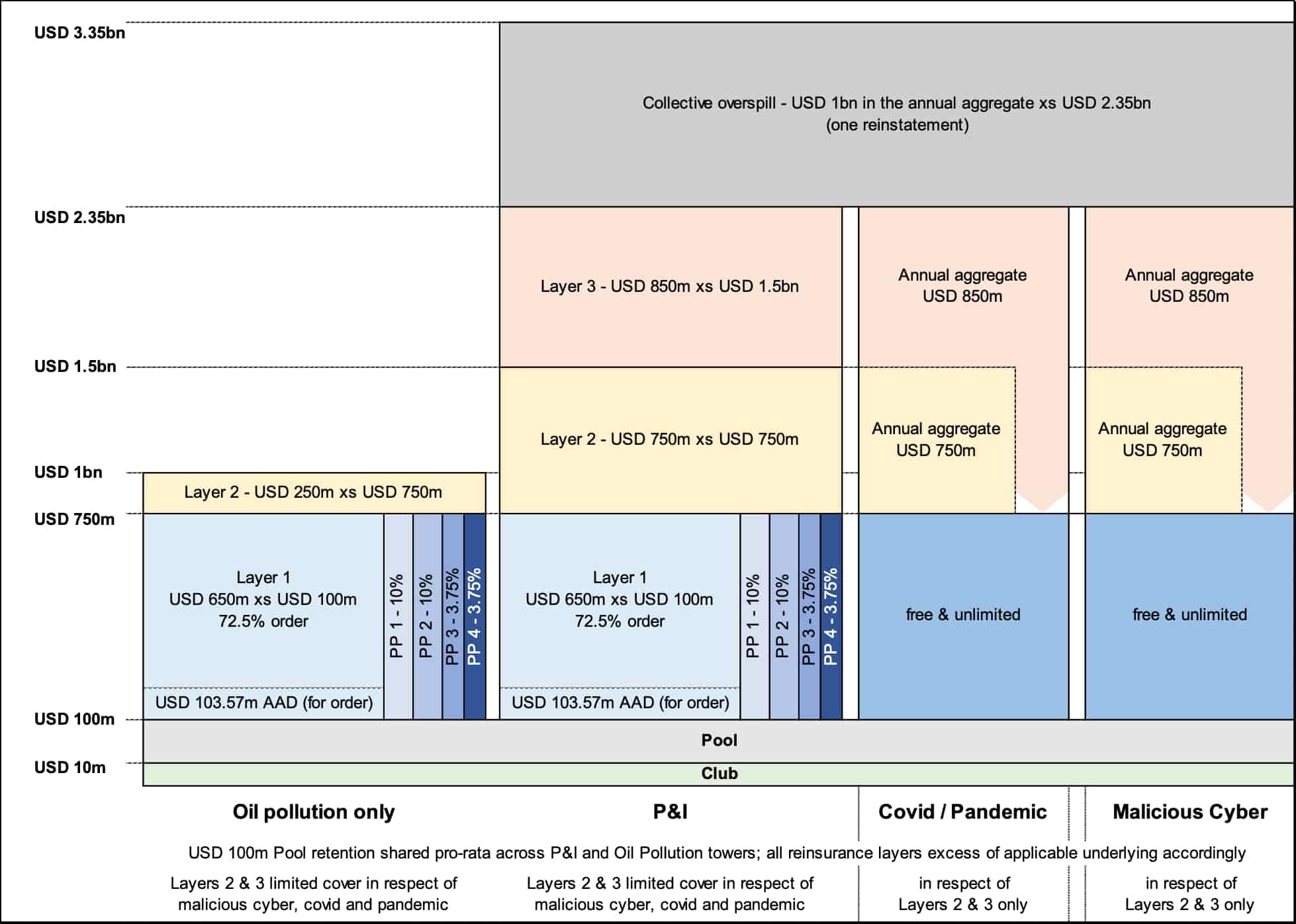

With this in mind, as part of the GXL, the IG has arranged four private placements amounting to 27.5% of Layer 1 of the programme ($650 million xs $100 million), reducing the market share of Layer 1 from 75% to 72.5%.

The IG has also extended the cover offered by Clubs to their shipowner members by expanding Layer 3 of the GXL from $600 million excess of $1.5 billion to $850 million excess of $1.5 billion.

According to IG, this means that its Collective Overspill cover of $1 billion is now in excess of $2.35 billion as opposed to $2.1 billion in 2025/26.

IG’s diagram below illustrates the layer and participation structure of the GXL programme for 2026/27.

“The GXL allows IG Clubs to offer uniquely high levels of free and unlimited coverage for most of the risks they insure. In securing this renewal, the IG is therefore grateful for the ongoing support of its leader, AXA XL, and also to its many other longstanding reinsurance partners,” IG said.

Mike Hall, Chairman of the IG’s Reinsurance Committee, commented, “The International Group’s successful completion of the 2026 reinsurance renewal underscores the strengths and resilience of the mutual system.

“The ability to provide the high levels of cover that our shipowner members require at competitive terms reflects the effectiveness of collective negotiations and the long-standing relationships with our reinsurance partners.

“I am also pleased to announce that Bjornar Andresen will be succeeding me as the Committee Chair for the 2027/28 renewal. Bjornar, the Chief Underwriting Officer at Gard, is already well known to the reinsurance markets and has been a member of the Reinsurance Committee since 2018.

“Having worked closely with Bjornar during the present renewal discussions, I have no doubt that I am leaving the Committee and the IG in very good hands.”