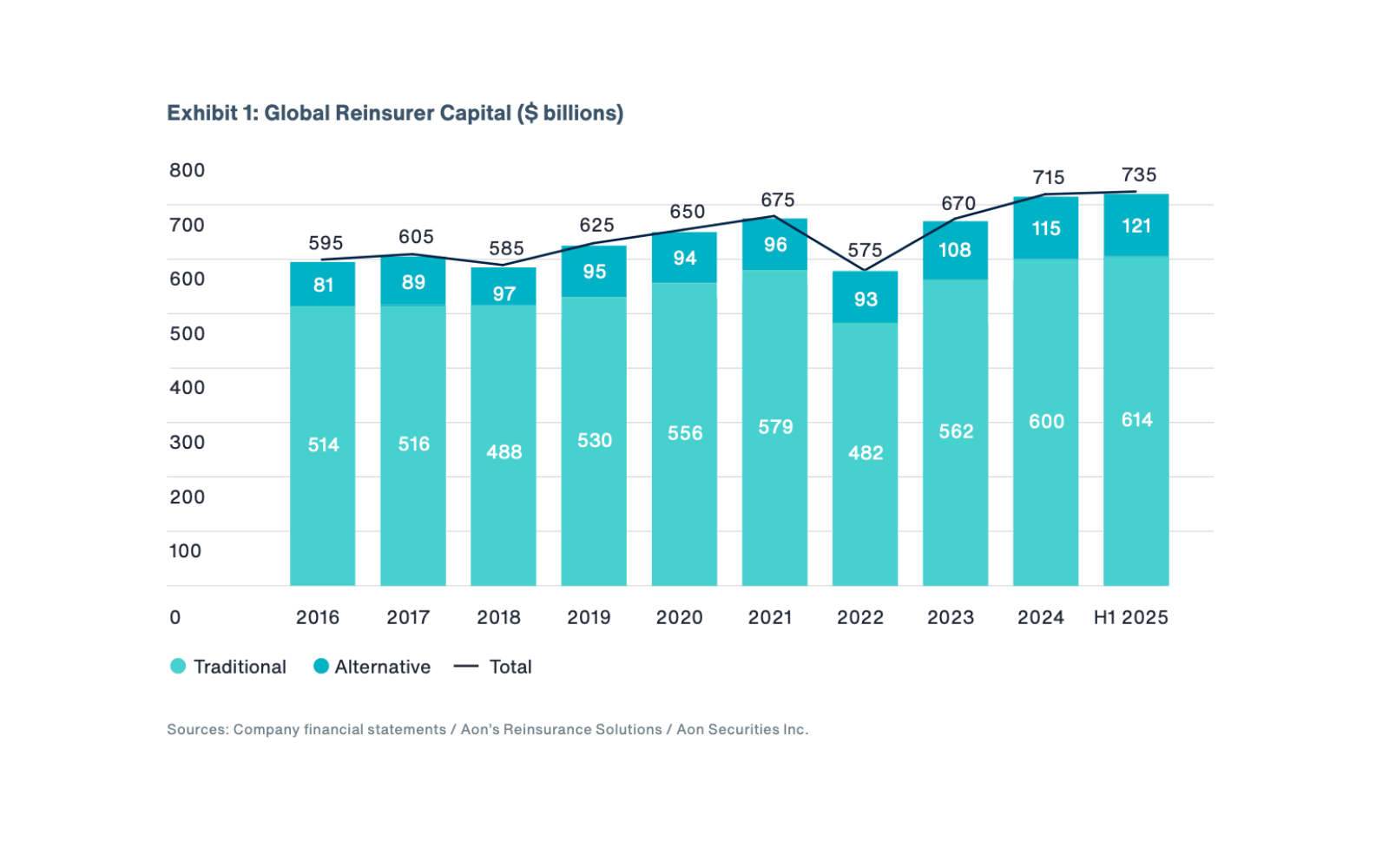

A new report from Aon has hailed the attractive yet dynamic reinsurance market, noting that buyers can seize a strategic advantage amid global reinsurance capital reaching a record $735 billion as of June 30, 2025.

According to the firm’s new report, the record reinsurance capital was driven mainly by retained and redeployed earnings, both in the traditional and alternative capital sectors.

Within the capital total, alternative capital reached a record $121 billion, with outstanding catastrophe bond volume rising to $54 billion.

Aon’s report also showed heightened demand for facultative reinsurance, highlighting its importance as a strategic tool to support insurer growth in an increasingly competitive insurance market.

Elsewhere, Aon noted that while global insured catastrophe losses topped $100 billion in H1 2025, ceded losses to reinsurers were relatively modest, with capacity supported by strong reinsurer results.

The firm’s report continued, “The average combined ratio across 30 global reinsurers was 94.8% for 1H 2025, an increase from 89.5% in 1H 2024. Meanwhile, reinsurers’ average ordinary investment return decreased marginally to 3.9% (2024: 4.1%) on an annualized basis in the 1H 2025, albeit with reinvestment rates generally remaining above book yields.

“Overall, reinsurers’ average return on equity was 14.5% on an annualized basis, lower than in 2023 (17.6%) and 2024 (15%), but remaining well ahead of the cost of equity, which is estimated to range from 8-10%.”

Speaking at Aon Reinsurance Solutions’ first renewal discussion ahead of the annual reinsurance industry meeting in Monte Carlo, Executive Managing Director and Global Property Segment Leader Tracy Hatlestad said the broker expects reinsurers to meet target ROEs on property catastrophe books even if rates decline by 10% or more at the January 1, 2026, renewals.

Turning back to the report, Alfonso Valera, CEO of International for Reinsurance Solutions at Aon, said, “Buyers can use the favourable reinsurance market dynamics to seize a strategic advantage, and so we are assisting our clients to secure the capital that can accelerate growth.

“Success in today’s re/insurance market depends on anticipating and responding to change and opportunity using the full spectrum of solutions.”

Stephen Hofmann, CEO of the Americas for Reinsurance Solutions at Aon, stated, “Insurers can stay competitive and remain relevant to their customers by leveraging attractively priced and diverse capital, and revisiting their long-term strategies and product mixes to support growth and manage volatility.

“Building best-in-class strategies – from capital deployment and talent to distribution focus and underwriting innovation – is essential for thriving in today’s attractive, yet dynamic market.”