The 2025 reinsurance buyers survey from Moody’s Ratings reveals a “decisive shift towards rate reductions” for property reinsurance risks when compared to prior years, while demand for coverage is expected to rise as attachment points hold for another year.

This annual survey conducted by Moody’s provides a useful snapshot of reinsurance market sentiment ahead of the busy conference season and key January 2026 renewals.

The main difference this year when compared with 2024 and 2023, when many survey respondents expected property reinsurance pricing to remain stable or rise, is that around 75% said they expect further declines in property reinsurance rates in 2026. Less than 5% of survey respondents said they expect prices to remain stable, and around 20% expect prices to increase.

“Our survey results support broader market signs that property reinsurance pricing has passed its 10-year peak and will continue to soften (in the absence of a major catastrophe loss) following several years of hard market conditions,” said Moody’s.

In terms of drivers of the expected declines in property lines pricing, 36% of respondents ranked increased reinsurance capacity provided by traditional players as the main driver.

Moody’s explained: “The increased competition for property reinsurance risks among traditional reinsurers is in large part a result of strong profitability in recent years, following year-over-year premium rate increases and much tighter contract terms and conditions, which included higher attachment points and the elimination of most aggregate covers. These changes have helped insulate reinsurers from losses from small and midsized catastrophes, with a greater proportion of these losses staying within primary insurers’ retention.”

As well as traditional reinsurance, 17% of survey respondents highlighted the greater availability of alternative, or third-party reinsurance capital as another key contributor to lower pricing in the property space, alongside moderating loss cost trends in property lines, while 17% feel prices for property reinsurance coverage have been too high and will come down as a result.

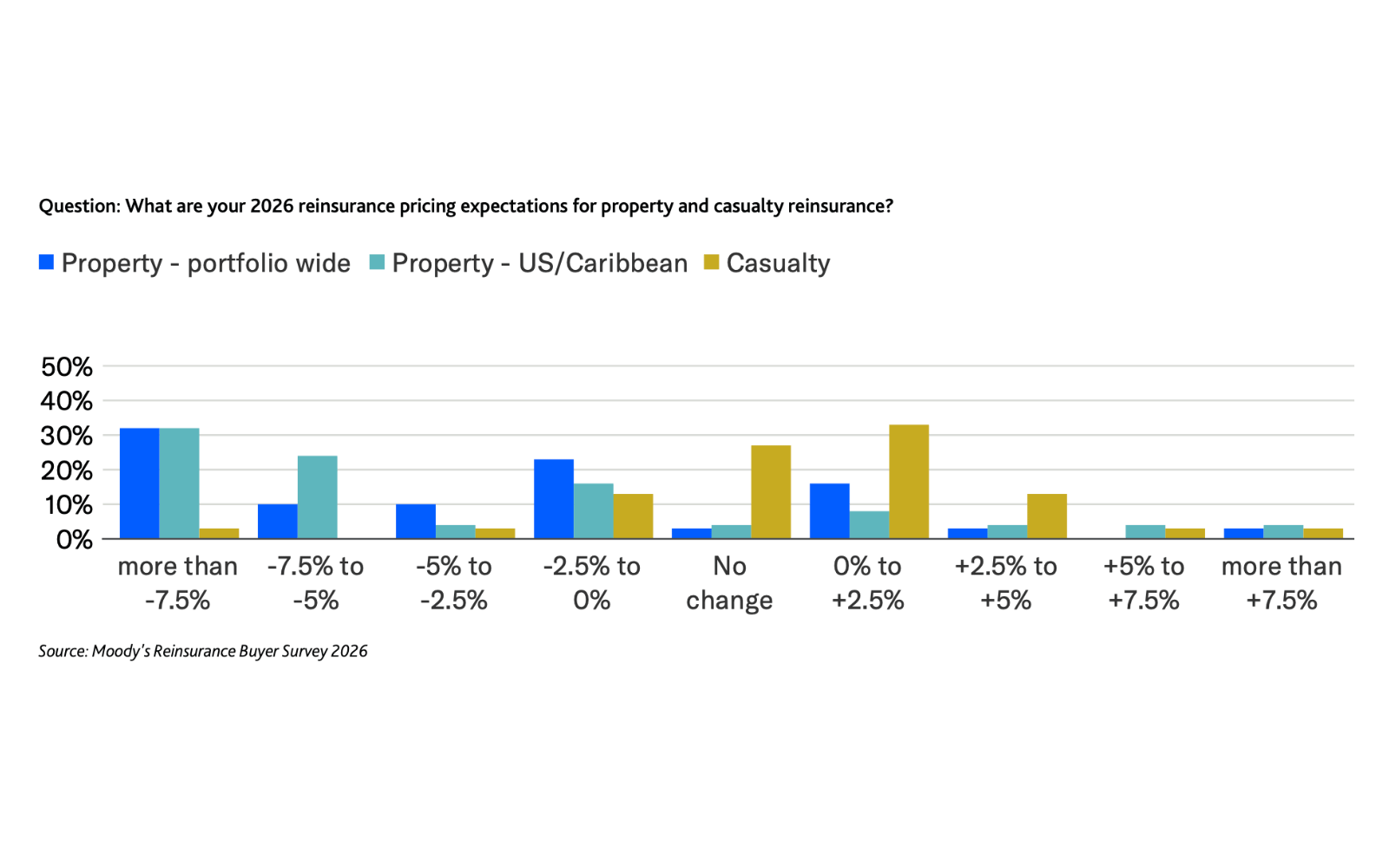

Interestingly, the reinsurance buyers surveyed by Moody’s had divergent views on the level of expected price reductions for property and casualty reinsurance in 2026, which you can see in the Moody’s chart below.

As the above chart highlights, some buyers also expect stable or rising prices in casualty reinsurance programmes next year, which Moody’s said is driven by rising loss cost trends and more constrained availability of reinsurance capacity.

“Most respondents expect casualty claims costs to increase further in 2026, with 47% of respondents expecting increases in the 0% to 5% range, and 37% expecting increases in the 5% to 10% range,” said Moody’s.

Adding: “Our survey results point to signs that pricing conditions for casualty reinsurance may be starting to moderate, however, with a growing proportion of respondents this year expecting prices to remain stable (27% compared with 12% of respondents last year) and a larger share of respondents expecting premium rate declines (19% compared with 9% of respondents last year).”

In terms of demand, the survey results point to strong demand for property reinsurance coverage in 2026, with 33% stating they intend to buy more reinsurance for US/Caribbean coverage, while 21% expect to purchase more property portfolio wide coverage.

“The remaining survey participants anticipated they would maintain the same level of property reinsurance buying for next year. This represents a change from the last couple of years, when some of our surveyed insurers said they expected to reduce their property reinsurance programs, primarily because of concerns over the higher cost of reinsurance.

“The solid demand for property reinsurance coverage reflects the need for primary insurers to mitigate tail risk exposures, particularly in light of the continued above-average level of catastrophe losses incurred by the industry in recent years. Given ongoing pricing reductions and some easing of terms and conditions, insurers are finding more opportunities to expand their property catastrophe reinsurance programs,” said Moody’s.

For casualty reinsurance, 97% of respondents said they expect to purchase the same level of reinsurance coverage in 2026 as in the prior year, with just 3% intending to buy more.

“No respondents said they planned to reduce their casualty reinsurance program covers, compared to 3% that said they would cut coverage last year,” explained Moody’s.

Since the reset of rates and terms and conditions in the property reinsurance space in 2023, higher attachment points have been key for reinsurers as they moved away from aggregate covers and frequency losses. Importantly for sellers of protection, the Moody’s survey of buyers reveals that while there are some easing of T&Cs in the market, the majority expect attachment points to remain stable in 2026.

“As a result, primary insurers will continue to largely retain nonpeak losses (high frequency, lower severity catastrophe losses) such as those stemming from convective storms, wildfires and floods. In recent years, these types of events have grown as a share of total annual catastrophe losses for the industry,” said Moody’s.

Interestingly, Moody’s reports that a significant number of buyers expressed a desire to purchase more aggregate reinsurance protection in 2026, but it remains to be seen how much appetite sellers have for these exposures.

“A large proportion (71%) of respondents also said they were likely or very likely to purchase more coverage for tail risk in 2026. This is in line with the view by most surveyed companies that natural catastrophe risk will continue to increase. Among our respondents, 54% indicated they expect a minor increase in natural catastrophe risk in the coming year, while 31% said they expect a moderate risk increase (Exhibit 10). Only 11% of respondents said there would be no further rise in natural catastrophe risk,” explained Moody’s.