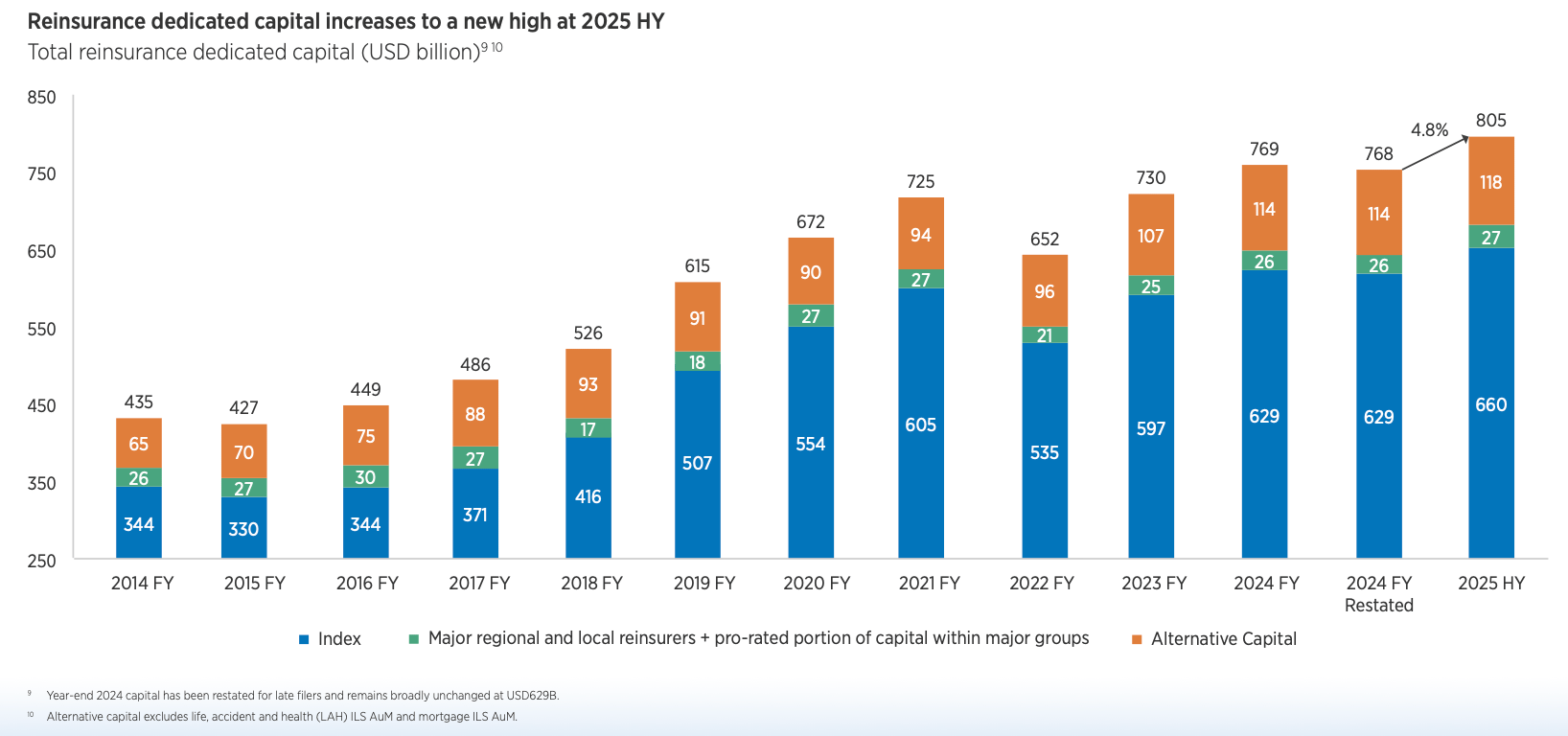

At the halfway point of 2025, global reinsurance industry capital hit a new high of $805 billion, reflecting growth of 4.8% from the end of 2024, as the underlying return on equity (ROE) of a subset of 16 reinsurers reduced but remained healthy at 12.6%, according to reinsurance broker Gallagher Re.

Total dedicated global reinsurer capital for the period moved from $768 billion at year-end 2024 to the aforementioned $805 billion at the end of June 2025, this highest level since Gallagher Re started this analysis, with growth in both traditional and alternative capital.

The broker says that capital growth, on a pro rata basis, is ahead of its projections. During the period, traditional capital increased by 5% to $660 billion, a new high, while alternative capital grew by 4% to a high of $118 billion.

Capital for INDEX companies, which account for 82% of total dedicated reinsurance capital, so the $660 billion, was driven by $15 billion in retained earnings, which Gallagher Re says accounted for roughly 50% of the capital growth in H1 2025.

Growth in non-life alternative capital to $118 billion was driven by both net inflows and favourable performance.

Below, you can see Gallagher Re’s chart on reinsurance capital growth since 2014.

The reinsurance broker also offers some insights into why it expects capital growth to persist through the second half of 2025. “Taking into account the industry’s profit outlook for the full year and considering capital returns, we estimate that 2025 FY traditional reinsurance capital will increase by about 8% (USD>57B). This assumes a neutral impact from financial markets and FX for the second half of the year. Retained earnings (net income minus dividends and share buy-backs) are expected to be the dominant contributor to capital build (USD >40B). Growth in traditional reinsurance capital for 2025 is slightly higher than we previously projected (>6%), benefiting from strong financial markets and FX movements during H1.”

The reinsurance broker’s report tracks the capital and profitability of the sector, and finds that although underlying underwriting profitability is robust and the running investment yield is stable, the underlying ROE of the subset of 16 reinsurers fell from 15.2% in H1 2024 to 12.6% in H1 2025.

According to Gallagher Re, this was the result of “earnings drivers outside P&C reinsurance underwriting or investment income.”

At the same time, the reported ROE came down from 19.6% to 17.7% for H1 2025, but as Gallagher Re emphasises, both the underlying and reported ROE remain above the average cost of capital.

Michael van Wegen, Head of Client & Market Insights International, Gallagher Re Global Strategic Advisory, commented: “We expect an underlying ROE of 13 -14% and a headline ROE of approximately 17-18% (assuming a ‘normal’ level of catastrophe losses in H2) for the full year, both of which remain significantly (1.5-2x) above the industry’s cost of capital. Supported by continued strong profitability, we expect traditional reinsurance capital to increase by roughly 8% in 2025.”

As ROEs fell, both the underlying and reported combined ratios of the subset of reinsurers increased, although at 87.5% and 94.7%, respectively, remain strong by historical standards. In fact, the broker’s data reveals that these results have only been bettered once since the launch of its 2014 reinsurance market report.

Natural catastrophe events, driven by the Los Angeles, California wildfires in January 2025, had an impact of 9.6% on the combined ratio in H1 2025, which is slightly above the normalised level of 9%.

However, higher investment gains of 3.4 percentage points offset the year-on-year rise in nat cat losses, as did higher prior year reserve releases of 2 percentage points.